How to Write a Check: A Step-by-Step Guide

Learn how to write a check with our step-by-step guide. Master the art of traditional payments for rent, bills, and more. Start writing your checks confidently today!

Rijvi Ahmed

Last updated on Dec 27th, 2023

When you click on affiliate links on QuillMuse.com and make a purchase, you won’t pay a penny more, but we’ll get a small commission—this helps us keep up with publishing valuable content on QuillMuse. Read More.

Table of Contents

Knowing how to write a check is a crucial life skill that everyone should possess. While cash and credit cards are widely used, there are still many situations where you’ll need to use a paper checkbook to pay bills, send money, or settle taxes.

If you find yourself in any of these situations and don’t know how to write a check, don’t worry.

In this article, we’ll provide you with an easy-to-follow, step-by-step guide to How to Write a Check that will make writing a check a breeze. So, let’s get started!

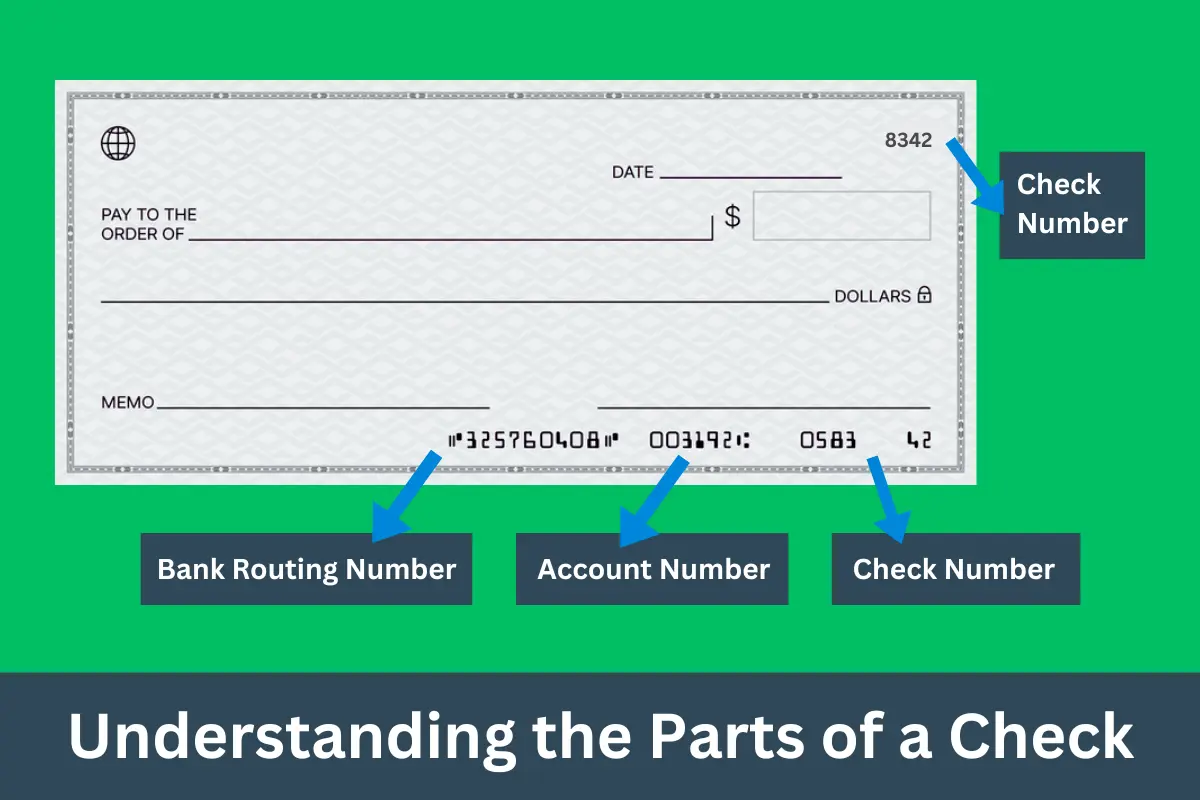

Understanding a check’s format

Yes, understanding the format of a check is important before writing one for the first time. Knowing the different parts of a check, including preprinted information and empty fields that need to be filled out, can help make the process easier.

Preprinted information typically includes

- Account holder’s name and information: The name and address—and sometimes phone number—of the checking account holder connected to the check is usually printed in the upper left corner.

- Check number: The check number is typically in the check’s top and bottom right corner. It can help account holders keep track of how many checks they’ve used.

- Bank routing number and account number: The routing number and account number are a series of numbers usually on the bottom of the check, with the routing number on the left side.

The Empty Fields

The rest of the empty fields are used to write out a check. These include the following:

- Date

- “Pay to the order” line for the recipient

- Dollar amount in numbers

- The dollar amount in words

- Memo line

- Signature line

How to write a check

It’s always important to be careful and accurate when filling out a check. Using a pen, make sure to use each field correctly to avoid any confusion or mistakes.

It’s important to write legibly and use both numbers and letters as indicated, to ensure that there is no confusion about the amount of money being deducted from your account and who it’s going to.

This will help you avoid any unnecessary frustration and save you from wasting checks.

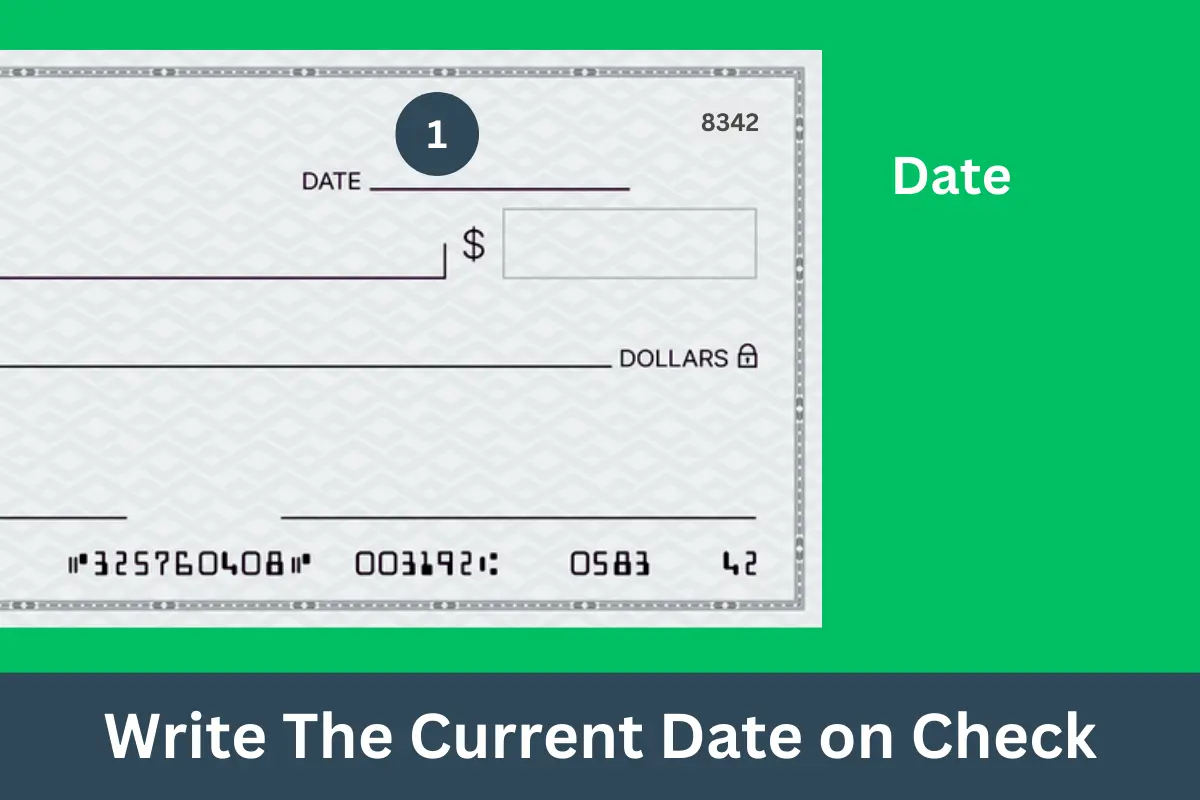

1. Date the check

Writing the date on a check is an important step and it’s good to know that postdated checks are legal but may still be processed before the date written on them. It’s important to be aware of the laws in your state and give reasonable notice to your financial institution if you plan on writing a postdated check.

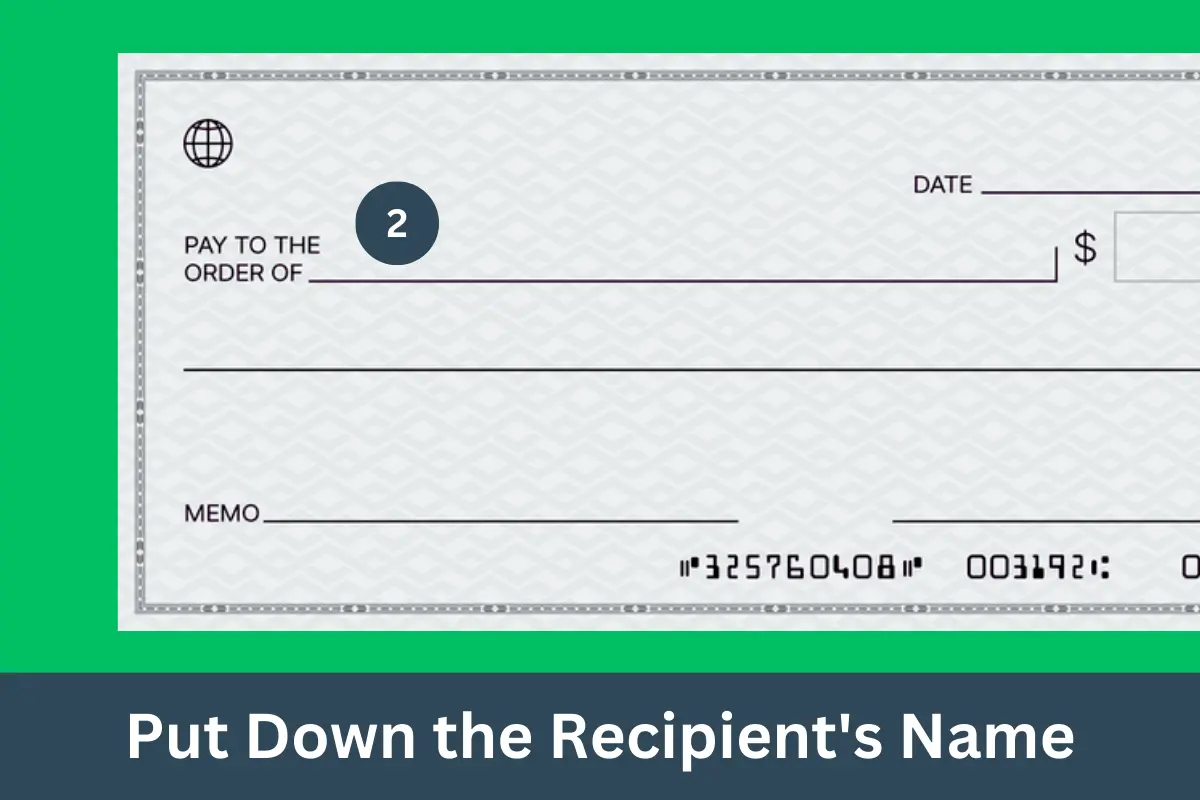

2. Put Down the Recipient’s Name

Writing the recipient’s name on the “Pay to the order of” line is an important step when writing a check. It ensures that the payment goes to the right person or organization.

For instance, if you’re paying rent, you’d write the name of your landlord or the apartment company in that space to ensure the funds go to the right place.

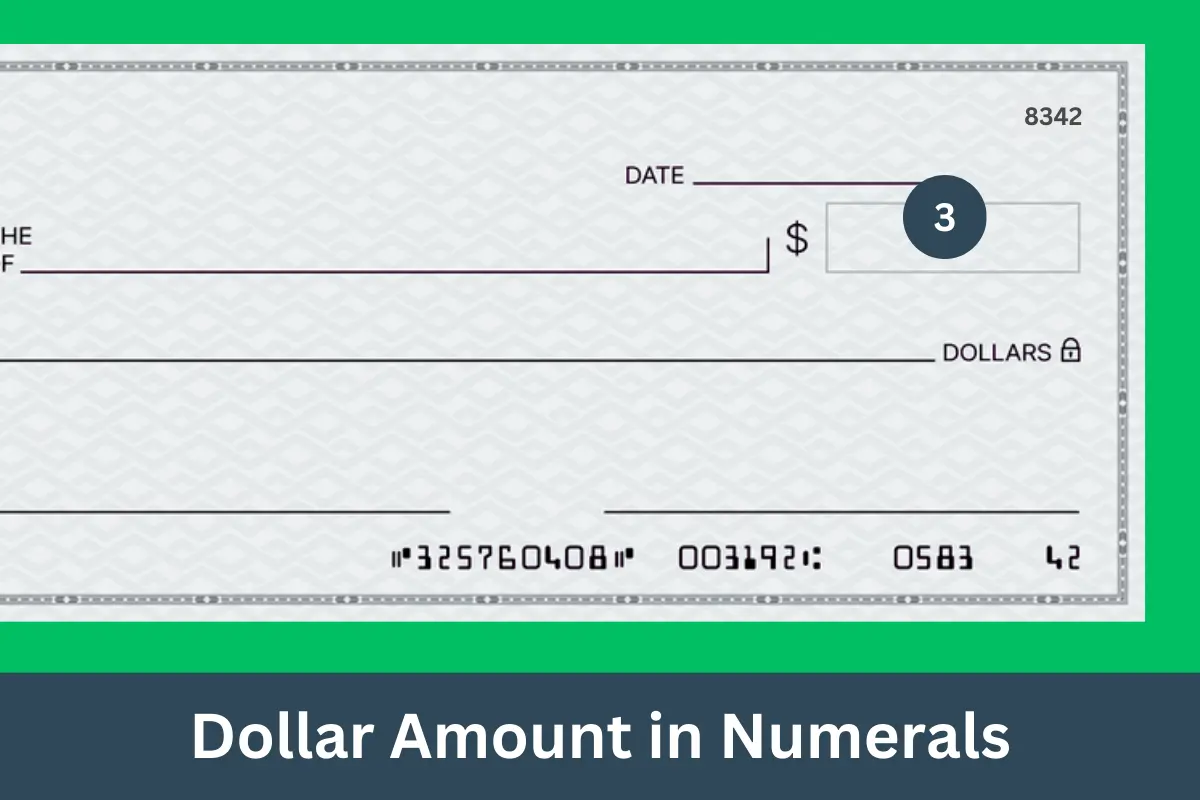

3. Fill in the Dollar Amount

When filling out the dollar amount on a check, it is important to write it correctly in both numbers and words. The box to the right of the “Pay to the order of” line is where you write the amount of the check-in in dollars and cents.

For example, if you are writing a check for $1,000 to the World’s Best Apartment Company, you would write “1,000.00” in the box.

Note that there is no need to write the dollar sign before the amount since it is already printed on the check.

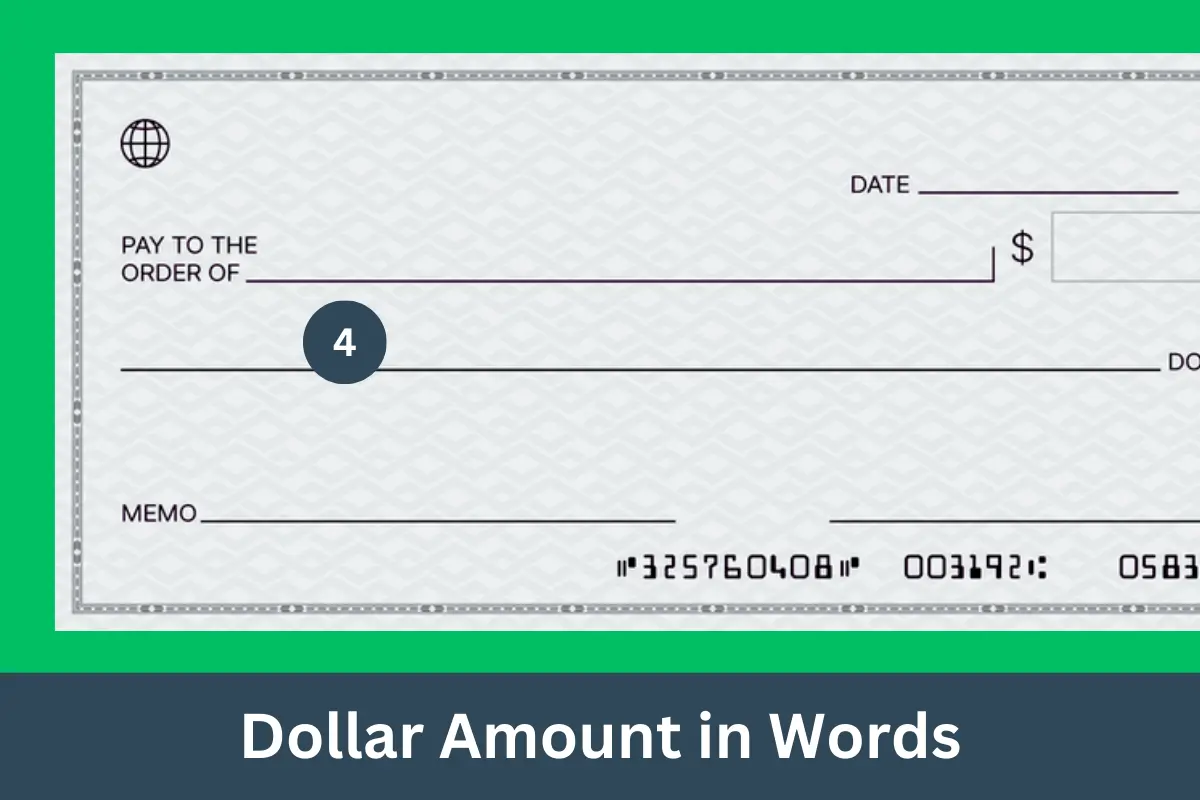

4. Spell Out the Dollar Amount

When writing a check, after filling in the box with digits, you must spell out the dollar amount of the check in the same way that you would say it out loud. You should do this on the line below the “Pay to the order of” line.

For example, if you need to make out a check for your internet bill of $126.50, you would write “One hundred twenty-six dollars and 50/100 cents”. It’s important to note that the number 26, when spelled out, is hyphenated and all larger numbers should be hyphenated when completing this line.

In addition, there’s no need to put the word “and” after “One hundred” and you don’t need to spell out the cents. Instead of spelling out the cents, use a fraction to indicate the amount, such as 50/100 for 50 cents. If the check is for an amount with no cents, such as $100, write out the word “One hundred” followed by the fraction 00/100.

After writing out the dollar amount of the check, remember to draw a line to fill out the remaining space. This will help prevent someone from altering the amount of the check after you’ve written it.

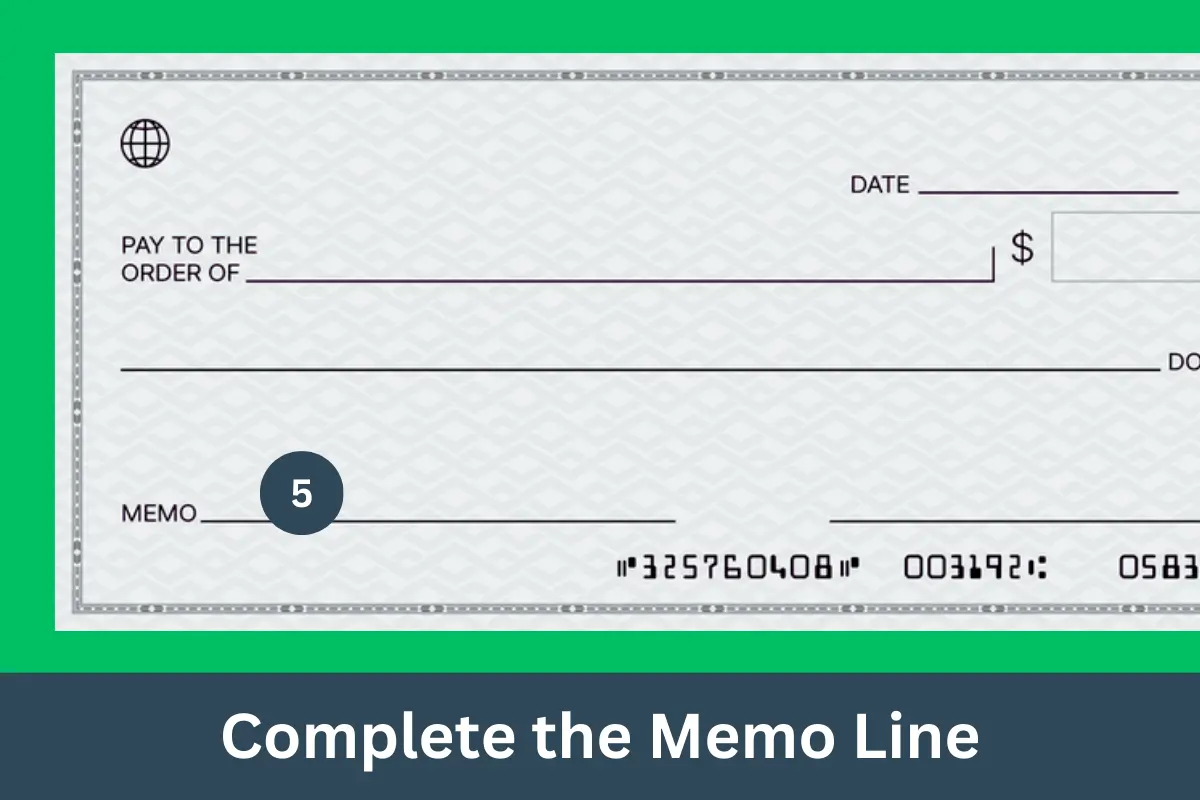

5. Complete the Memo Line (Optional)

It is helpful to know that the memo line on a check is for the user’s reference and is not necessarily important for financial institutions.

It’s good to know that we have the option to include a brief description on the memo line to help us remember what the check was for.

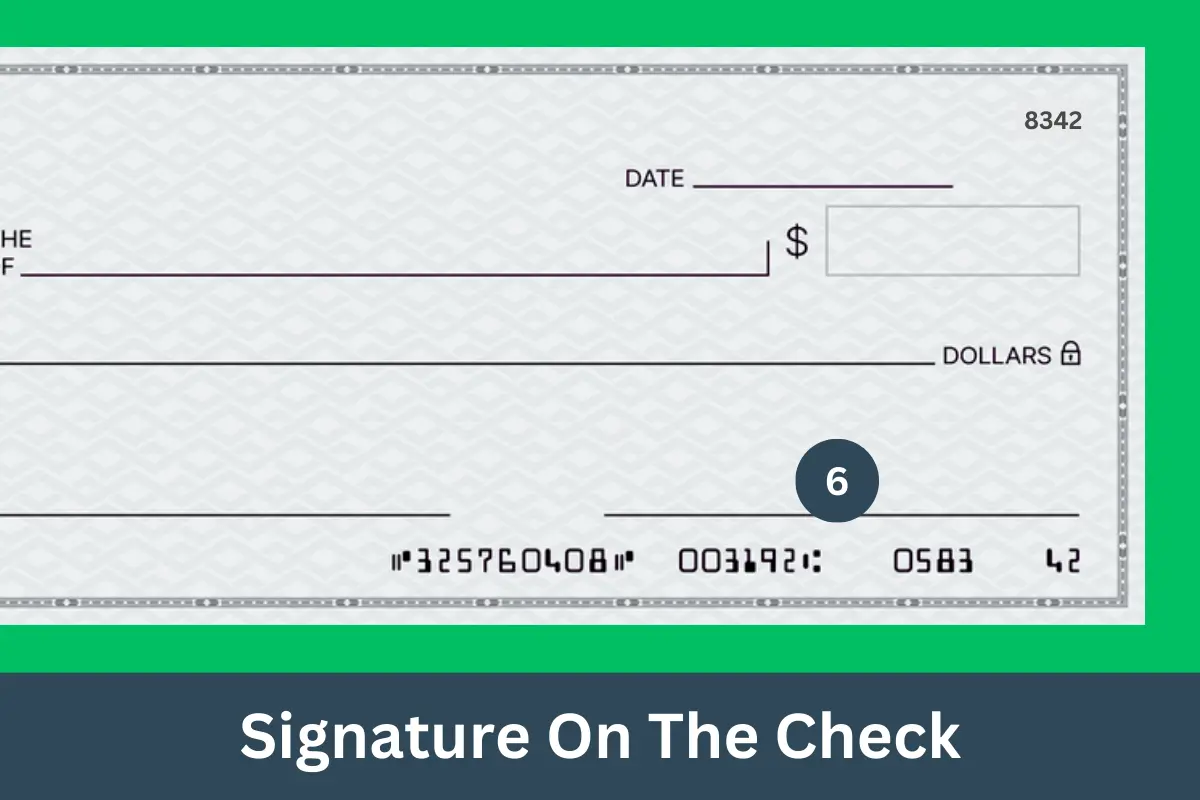

6. Sign the Check

It’s important to note that your signature on the check is a representation of your authorization to withdraw the funds from your account.

Therefore, it’s crucial to sign the check only when you’re sure that all the information is correct.

It’s also important to keep track of the check’s number and information to ensure that you can reconcile your account statement and track your spending.

Tips to Keep Your Checks Secure

While checks are safe, you can make sure they don’t matter to any illegal activity by following these steps:

- Use a pen to write a check: That’s a great point! It’s crucial always to use a black gel pen when filling out a check. If you use a different type of pen, there’s a risk that someone could erase the information and change the check.

Black gel pen ink is much harder to remove, making it a safer option.

So, make sure to always use a black gel pen when filling out your checks!

- Don’t hand anyone a blank check: If you give a blank check to someone else, he can enter any information he wants, including the recipient’s name and dollar amount.

- Avoid blank spaces: In particular, the line where you write the amount of the check must include a line drawn after the amount. This prevents someone else from changing the amount after the check is written.

- Order checks from a reputable company: To make sure your checks are legitimate, it’s wise to order them through your bank or credit union or from a well-known brand.

- Keep checks in a safe place: Put your checkbook in a secure spot at home, and avoid carrying a checkbook with you when you’re away from home.

- Monitor checks: It’s always a good idea to keep track of your account after writing a check to ensure that it has been deposited or cashed. If you notice that the check hasn’t been processed after a reasonable amount of time, you may want to consider placing a “stop payment” on the check. However, it’s important to keep in mind that a stop payment typically comes with a fee.

- Be careful when mailing checks: If you’re mailing a check, consider dropping it off at a post office or handing it to a mail carrier rather than leaving it in an unattended mailbox. This reduces the risk of the check being stolen.

- Shred checks instead of tossing them in the trash: Doing so can help protect your data and keep your checks from being stolen.

FAQs

Is writing a check to myself allowed?

Yes, you can do so by naming yourself as the recipient. That’s one way to move money from one bank account to another. Either deposit the check at your new bank or use its mobile check deposit service, if it has one. Be sure to have a valid, government-issued photo ID.

What is a postdated check?

A postdated check has a future date written on it. For instance, if you’re mailing your December rent check on Nov. 28 but won’t have the necessary funds until the first of the month, you might date the check on Dec. 1. However, postdating checks is not recommended and usually is a waste of time. The bank doesn’t have to honor that later date, and overdraft or insufficient funds fees may apply if you don’t have the money to cover it.

What should I do if I make a mistake?

If it’s a minor slip-up, draw a single line through the word and rewrite it. You may also need to write your initials next to the change. Whether your check is acceptable will be at the bank’s discretion. If you’re worried about whether it’ll be accepted, the safest option is to invalidate the check by writing “void” across it in large letters and writing a new check.

How we've reviewed this article

Our content is thoroughly researched and fact-checked using reputable sources. While we aim for precision, we encourage independent verification for complete confidence.

We keep our articles up-to-date regularly to ensure accuracy and relevance as new information becomes available.

- Current Version

- Dec 27th, 2023

- Dec 27th, 2023